2026 Lithium-Ion Battery Market Forecast: Technologies, Applications, and Key Players

2026.02.09

As the global energy transition accelerates, the lithium-ion battery market has evolved from a niche electronics component into the backbone of modern industrial infrastructure. 2026 stands as a definitive turning point where massive capacity expansions meet a second wave of technological innovation. For business stakeholders, understanding this landscape is critical for securing supply chains and maintaining a competitive edge in an electrified future.

Quick Insights: What to Expect in 2026

l Market Valuation: Forecasts suggest a range between $80 billion and $166 billion, driven by a 20%+ CAGR.

l Technology Shift: The "46-series" large cylindrical cells and high-capacity LFP (500Ah+) will dominate industrial and ESS applications.

l Regional Dominance: While Asia remains the powerhouse, North America and Europe are racing to localize "Gigafactory" clusters.

2026 Lithium-Ion Battery Market Size and Growth Outlook

The trajectory of the lithium-ion battery market forecast for 2026 indicates robust, double-digit growth, though specific valuations vary by analyst. Research Nester projects the market to hit $166.2 billion by 2026, while Mordor Intelligence estimates a valuation of $136.28 billion. Even conservative estimates from Grand View Research place the market at $80.03 billion, with a consistent CAGR exceeding 21% through 2033.

Primary Growth Drivers

l Mass EV Adoption: The automotive sector remains the primary revenue engine, accounting for up to 54% of market share. In 2026, the shift from subsidy-driven to consumer-driven demand is projected to be largely underway.

l Renewable Energy & AI Data Centers: Energy Storage Systems (ESS) are growing at a CAGR of nearly 30%. Specifically, the rise of AI training loads requires sophisticated battery backup to manage power fluctuations and ensure grid stability.

l Supportive Climate and Industrial Policies: Government policies are accelerating localized battery manufacturing and clean technology adoption. U.S. IRA incentives, China’s industrial upgrading, and the EU’s Battery Passport rules are driving investment, compliance upgrades, and global supply chain restructuring.

Market Headwinds

Despite the optimism, the industry faces significant challenges. Supply chain concentration in Asia remains a geopolitical risk, and the "Battery Passport" regulations in the EU (which will become mandatory in 2027) will demand unprecedented transparency in carbon footprints. Furthermore, while metal prices have cooled, the volatility of lithium and cobalt continues to necessitate diverse chemistry portfolios.

Core Technologies Defining the Global Lithium-Ion Battery Market

In 2026, the global lithium-ion battery market will see a clear divergence in chemistry and form factor, optimized for specific B2B use cases ranging from long-haul transport to grid-scale storage.

1. Dominant Chemistries: The LFP vs. NMC Divide

l LFP (Lithium Iron Phosphate): Favored for its safety and cycle life, LFP and its successor LMFP (Lithium Manganese Iron Phosphate) are expected to capture a massive share of the ESS and entry-level EV markets.

l NMC/NCA (High-Nickel): These remain the gold standard for high-performance and long-range applications. The industry is moving toward "ultra-high nickel" variants (90%+ nickel) to further increase energy density and reduce cobalt dependency.

2. The Rise of the 4680 Cell Format

The 4680 cylindrical format (46 mm diameter, 80 mm height) is expected to become a trend in 2026.

l Design Divergence: Tesla is refining Dry Battery Electrode (DBE) processes to lower costs, while BYD and Samsung SDI have developed variants for high-rate performance.

l EVE’s Contribution: EVE Energy has established itself as a frontrunner in the 46-series large cylindrical segment, providing high-precision manufacturing solutions that support global OEMs in achieving better thermal management and structural efficiency. If you’re interested, click here to contact us and learn more about EVE’s latest advancements in 46-series batteries!

3. Emerging and Next-Generation Technologies

The year 2026 is also expected to see the transition of several "next-gen" technologies from pilot stages to early commercial adoption:

l Silicon-Rich Anodes: While graphite remains the standard, Silicon Carbon (SiC) anodes are gaining momentum. High-performance batteries in 2026 will utilize 10-50% (or even higher!) silicon content to achieve extreme fast-charging (80% in under 15 minutes) and energy densities exceeding 300 Wh/kg.

l High-Manganese Cathodes (LMR): Lithium-rich Manganese-based (LMR) cathodes are attracting significant investment (e.g., from Ford and GM). These offer energy densities up to 270 Wh/kg while bypassing the high costs and environmental concerns associated with nickel and cobalt.

l Solid-State Batteries (SSB): 2026 is the year of "early adoption" for solid-state cells. Leading European automakers like Mercedes-Benz and BMW have begun road-testing these units, which promise densities up to 500 Wh/kg and enhanced safety through non-flammable solid electrolytes.

l Sodium-Ion Batteries: Functioning as a complementary technology, sodium-ion batteries are likely to see increased application in the ESS sector and low-speed mobility in 2026, offering a lower-cost, high-safety alternative that performs exceptionally well in low temperatures.

Key Application Segments Driving Demand

The demand landscape in 2026 is characterized by "dual-speed" growth, with ESS emerging as a primary growth engine alongside the maturing EV sector.

1. Electric Vehicles (EVs) and E-Mobility

The automotive sector remains the largest demand driver, with the lithium-ion battery market projected to reach USD 141.75 billion in 2026, according to Mordor Intelligence.

l Commercial & Heavy-Duty: The growth of electric trucks is a highlight for 2026. As battery prices fall, electric trucks are becoming cost-competitive for long-haul routes.

l Micro-mobility: In Asia and Europe, electric two-wheelers and three-wheelers are increasingly adopting swappable LFP battery modules for urban logistics.

2. Energy Storage Systems (ESS)

ESS is the "breakout star" of 2026, with growth rates approaching 30%.

l AI Data Centers: The explosion of AI computing power requires massive, reliable backup systems. Data centers are shifting from lead-acid to lithium-ion UPS systems that can also provide ancillary services to the grid.

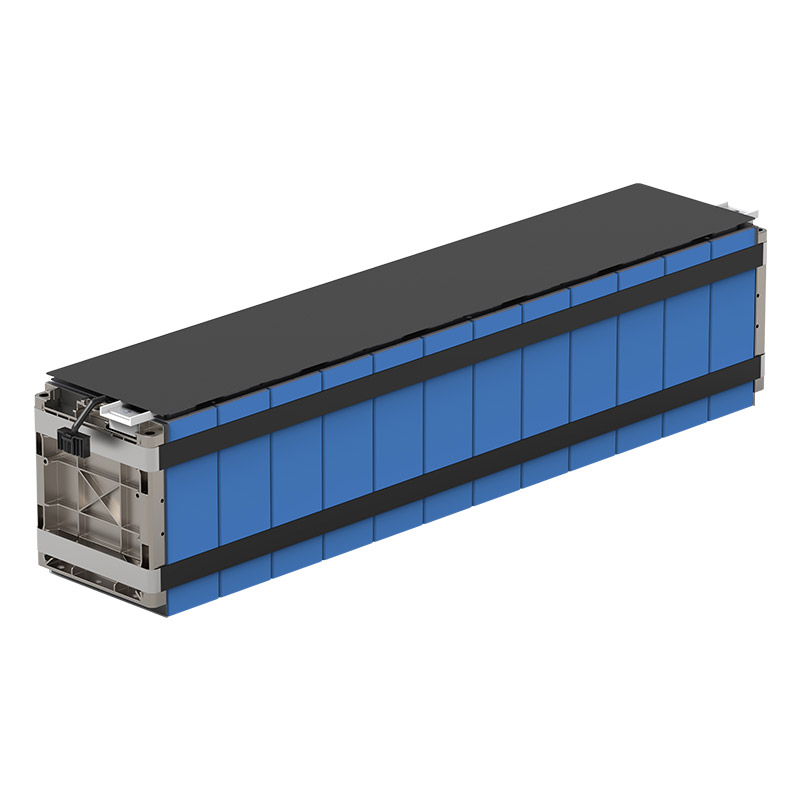

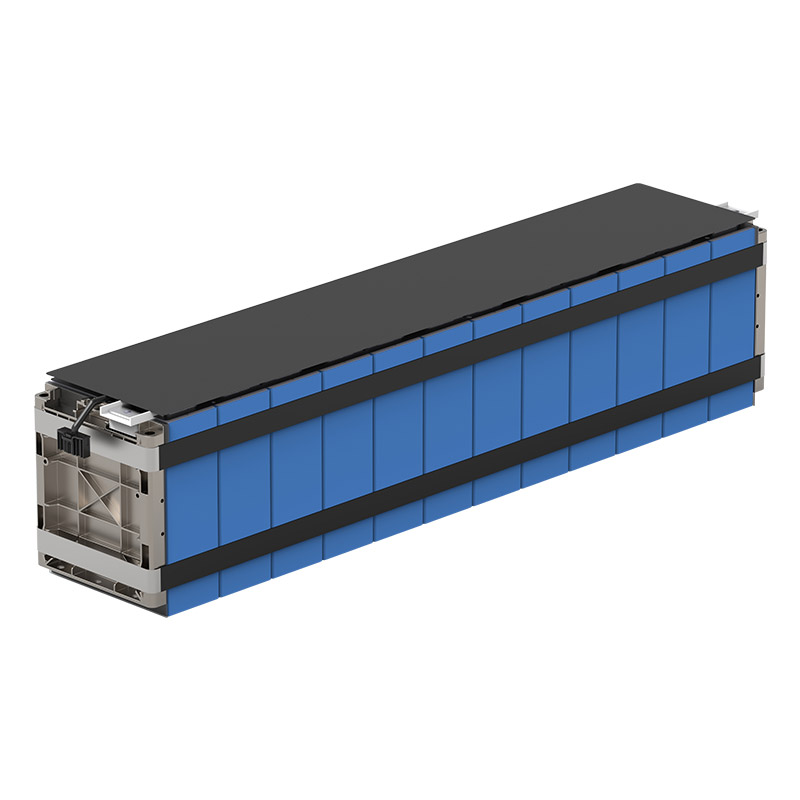

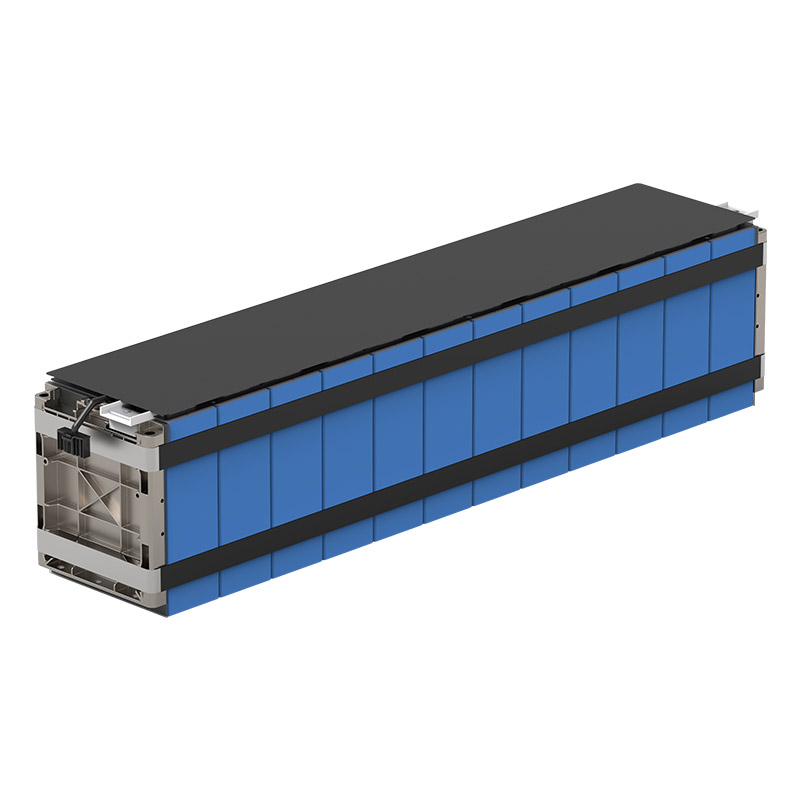

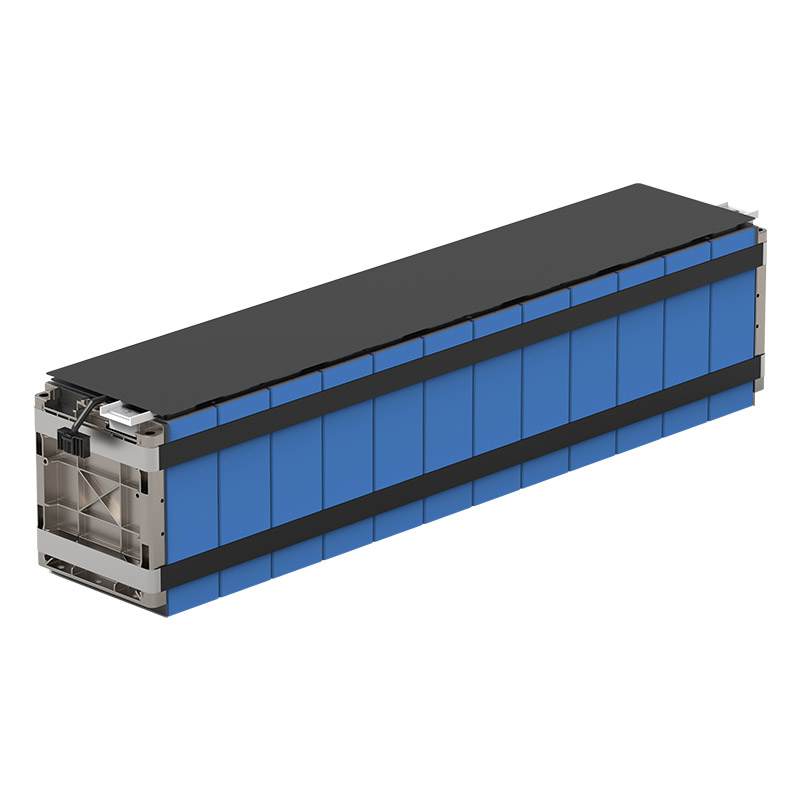

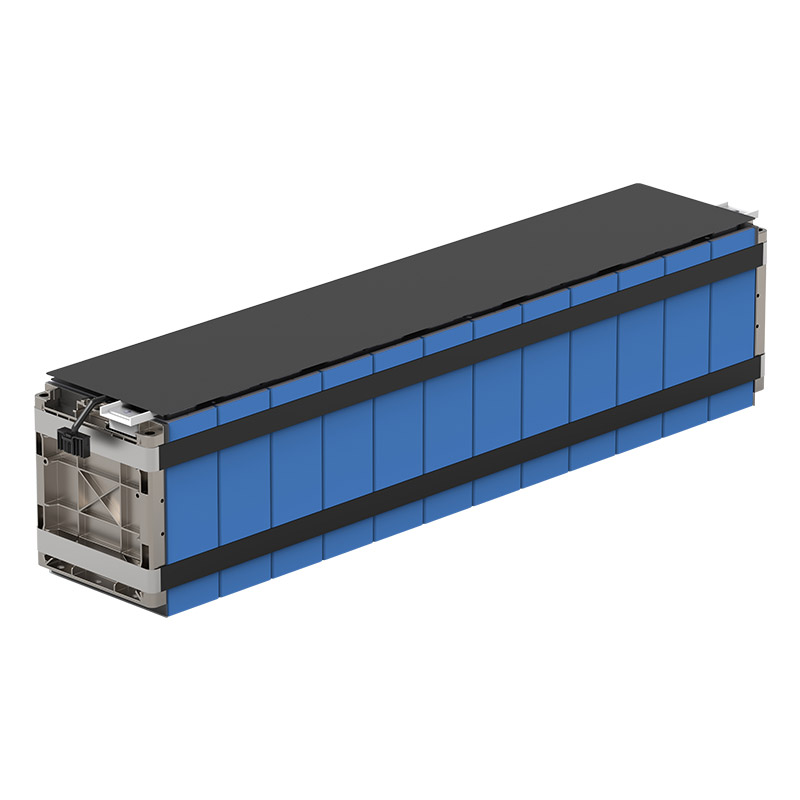

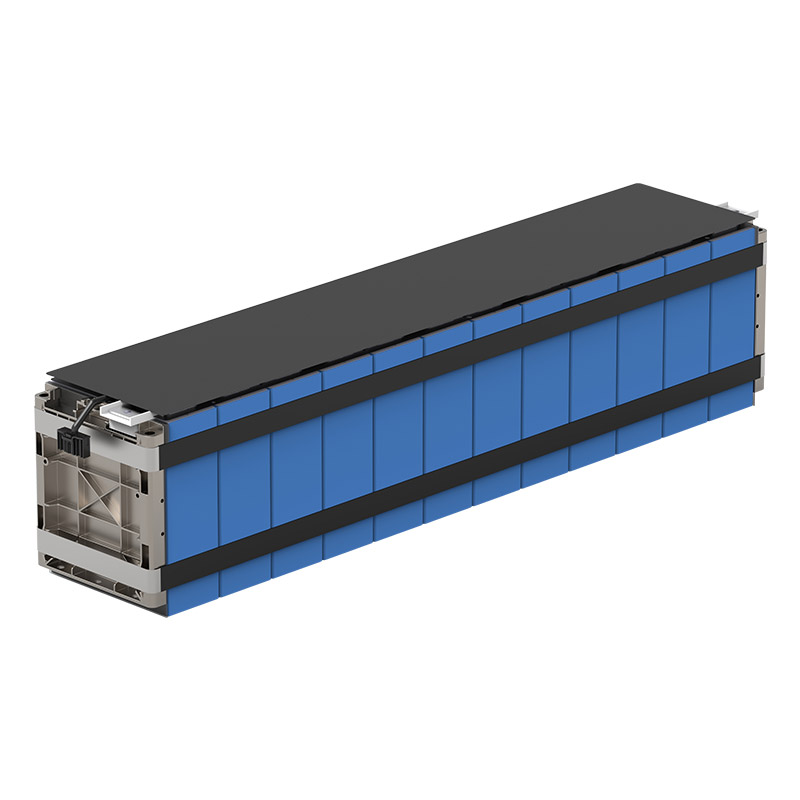

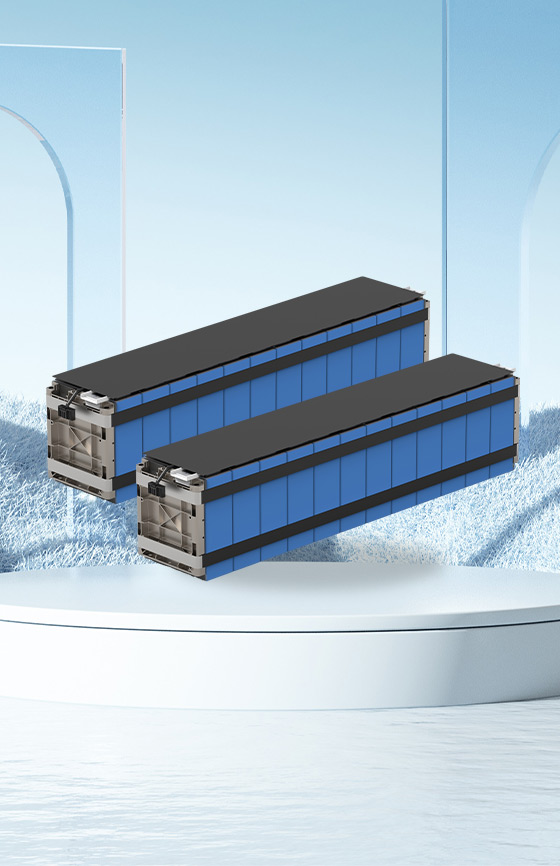

l Giga-scale Projects: Over 120 Giga-scale battery projects are expected to be operational in 2026. The shift toward ultra-large capacity cells (like the EVE 628 Ah lithium-ion battery cell) allows for 6 MWh+ energy storage containers, dramatically lowering the balance of system (BOS) costs.

EVE 628 Ah lithium-ion battery cell for utility-scale ESS.

Inquiry, samples, and bulk orders available via EVE’s official e-commerce platform.

3. Consumer Electronics & Industrial Automation

While smaller in volume, these segments potentially drive the highest technical specifications. Examples include:

l On-device AI: New smartphones and AR/VR glasses require high-density batteries to power complex AI algorithms without increasing device thickness.

l Industrial Robotics: AGVs (Automated Guided Vehicles) and AMRs (Autonomous Mobile Robots) in smart warehouses rely on lithium-ion for 24/7 operation and rapid "opportunity charging."

Regional Outlook: Where Lithium-ion Battery Growth Is Concentrated

The 2026 global landscape is defined by regional specialization and aggressive policy-driven localization.

1. Asia-Pacific Leadership

With a projected CAGR of 30.8%, the region remains led by China, accounting for over 80% of global capacity. Other countries are also advancing localized strategies; for instance, Indonesia is utilizing its nickel resources for NMC production, while India’s PLI scheme aims for 50 GWh of capacity.

2. North America & Europe

Western markets are actively promoting reduced reliance on Asian supply chains while intensifying carbon footprint oversight. The U.S. Inflation Reduction Act (IRA), for instance, requires full battery component localization by 2029 for eligibility for the battery-related tax credit.

Meanwhile, the EU’s Battery Passport and Green Deal enforce strict carbon footprint and recycling standards, positioning Europe as a premium hub for sustainable, high-specification battery production.

3. Strategic Emerging Markets

New players are also utilizing resource advantages to move up the value chain. For instance:

l Morocco is emerging as a critical gateway for African minerals to Western markets.

l South America’s "Lithium Triangle" is shifting focus from raw ore exports toward localized chemical processing.

This localized approach ensures that while China retains scale, new clusters are providing the resilience needed for a multipolar energy economy.

Key Players in the 2026 Lithium-Ion Battery Market

The competitive landscape is a high-stakes battle between legacy giants and innovative tier-two challengers.

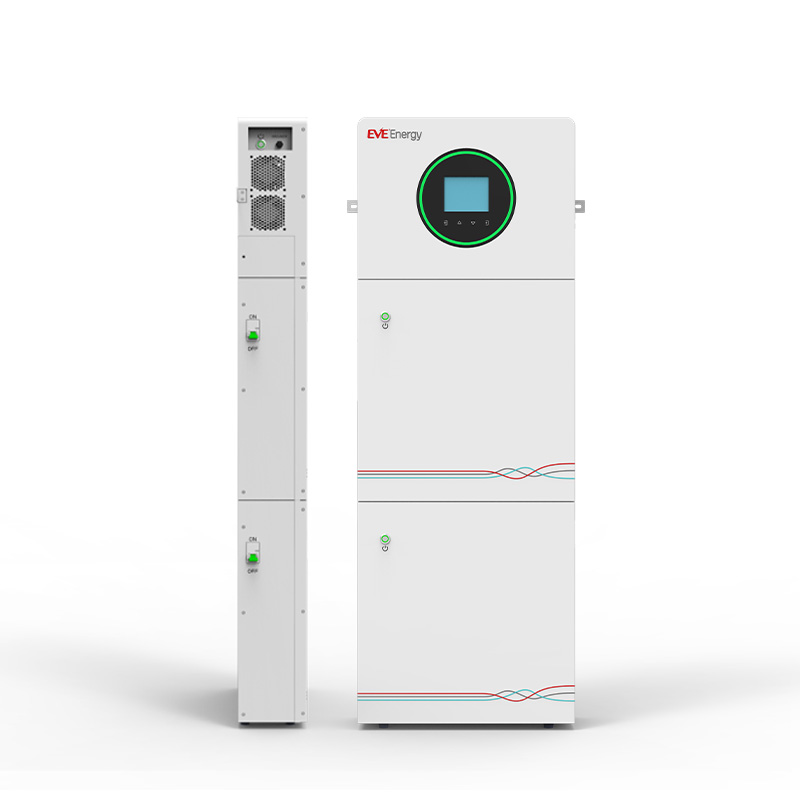

1. EVE Energy:

EVE Energy is a key player in the 2026 lithium-ion battery market, driven by rapid global expansion and advanced product innovation. Its Jingmen “Lighthouse Factory” leads smart cylindrical cell manufacturing, while new capacity in Hungary and Malaysia strengthens its international supply network. Flagship products such as the 46-series large cylindrical cells, 628 Ah “Mr. Big” ESS cells, and next-generation solid-state battery development position EVE strongly in EV and energy storage markets worldwide.

2. CATL: The undisputed leader in the lithium-ion battery market. Their Shenxing Superfast Charging battery and foray into condensed matter batteries for aviation keep them at the technological frontier.

3. BYD: Vertically integrated from mines to vehicles, BYD remains a pivotal force in the global energy ecosystem. Their Blade Battery 2.0 remains the gold standard for safety.

4. LG Energy Solution: The primary NMC supplier for Western OEMs, despite facing capacity utilization challenges, continues to lead in patent filings and next-gen material research.

5. Samsung SDI: Focused on the premium market with high-nickel NCA technology and accelerating the roadmap for All-Solid-State Batteries (ASB) for a 2027 launch.

6. SK On: Diversifying its client base and pivoting toward LFP production in 2026 to capture the growing mid-range EV market.

7. Panasonic: Closely tied to Tesla’s 4680 roadmap, focusing on improving the yield and density of cylindrical cells in their North American Gigafactories.

Conclusion

As we look toward 2026, the global lithium-ion battery market is no longer just about capacity; it is about specialization, sustainability, and regional resilience. For enterprises—from ESS integrators to EV OEMs—the shift toward more affordable lithium-ion pricing and the arrival of high-manganese and silicon-rich technologies present an unprecedented opportunity to stabilize energy costs and drive innovation.

Strategic choice of a battery partner is now one of the most critical decisions of the decade. Companies like EVE are bridging the gap between cutting-edge research and mass-market reliability, providing the high-performance cells required to power the 2026 industrial landscape.

Beyond cell performance, clients sourcing EVE battery cells also benefit from comprehensive compliance support, including international certifications and complete export documentation. This not only reduces procurement risk but also helps enterprises accelerate global project deployment with greater confidence and regulatory readiness.

Relevant information:

2. https://www.grandviewresearch.com/industry-analysis/lithium-ion-battery-market

3. https://www.grandviewresearch.com/press-release/global-lithium-ion-battery-market

4. https://www.researchnester.com/reports/lithium-ion-battery-market/1313

5. https://www.mordorintelligence.com/industry-reports/lithium-ion-battery-market

6. https://www.tsingyangrp.com/blog/tesla-4680-batterys-secret-sauce-dry-electrode-coating.html

7. https://www.mordorintelligence.com/industry-reports/lithium-ion-battery-for-electric-vehicle-market

10. https://www.evebattery.com/en/news-1891