LiFePO4 vs. Lead Acid: Performance, Applications and Supply Chain

2025.05.27

The worldwide LiFePO4 battery market is worth USD 20.96 billion in 2025 and might reach USD 117.62 billion by 2037 with a 15.2% CAGR.[1] In comparison, the lead-acid battery market can reach USD 73.96 billion by 2032 at a CAGR of 5.44% from USD 51.03 billion in 2025.[2]

Due to LiFePO4 batteries' increased cycle life, energy density, and use in electric cars and energy storage systems, growth rates are diverging. In the context of LiFePO4 battery vs. lead acid, the trend highlights a shift in market undercurrents, esteeming forward-looking battery technologies.

LiFePO4 vs. Lead Acid: Comparing Performance

Energy Density

In simple terms, LiFePO4 vs. lead acid shows a clear gap in how much energy each kilogram can store. Lithium‑iron‑phosphate packs roughly 150-200 Wh per kg, while flooded lead‑acid batteries sit closer to 30-50 Wh per kg. That means a LiFePO4 pack needs far less weight and volume for the same usable capacity. The higher density also stays more consistent as the battery ages, so sizing the system is easier. Lead‑acid banks might need oversizing to avoid running them below a specific state of charge, which further widens the practical density gap.

Discharge Rate

For high current draws, LiFePO4 vs. lead acid delivers different behaviors. A LiFePO4 cell can handle continuous rates of 0.5-1C and higher short bursts without sagging voltage too far. On the other hand, lead‑acid voltage drops sharply as current rises below room temperature. That drop decreases power and increases sulfation, which cuts life. In mixed‑load systems, think of trolling motors or off‑grid inverters. The flatter LiFePO4 curve keeps equipment stable and efficient.

Lifespan

Regarding cycle life, LiFePO4 vs. lead acid reads like two different eras. Expect 2,000-6,000 full cycles from a LiFePO4 battery before capacity dips, while a typical deep‑cycle lead‑acid pack manages 200-300. Partial‑state‑of‑charge operation hardly bothers LiFePO4 but wrecks lead‑acid plates through hard sulfation. Battery ageing is gentler, too. LiFePO4 chemistry resists corrosion that slowly ruins lead plates even when idle. Over the years, the lithium unit has kept more capacity and needs fewer replacements while trimming the total cost of ownership.

Temperature Adaptiveness

Cold weather brings pros and cons to LiFePO4 and lead acid use. Lead‑acid can still charge, though sluggishly, but available capacity falls steeply. LiFePO4 delivers strong discharge power to lower-than-zero temperatures but should not be charged below 0°C unless it has a built‑in heater or low‑temperature charging profile. At high heat, both chemistries lose life, yet LiFePO4 resists thermal runaway and plate corrosion better. In outdoor setups, heaters or insulated boxes are even the score, but system designers must budget for them when lithium is in the mix.

Safety, Eco‑Impact, and Cost

Wrap‑up time: looking at the broader picture of LiFePO4 vs. lead acid, each choice has trade‑offs. LiFePO4 is thermally stable, non‑corrosive, and sealed, reducing fire and acid‑leak risk. Lead acid is familiar and highly recyclable, but it contains toxic lead and electrolytes. Lithium mining raises environmental concerns, yet lead smelting has its own heavy‑metal footprint. Upfront cost still favors lead‑acid in many markets, but lithium's longer life can flip the lifetime economics, where labor or interruption is pricey. Picking one over the other hinges on budget, weight limits, cycle demands, and how much maintenance you're willing to do.

Lithium Iron Phosphate vs. Lead Acid: Applications

LiFePO4

ü Residential and commercial solar energy storage systems.

ü Off‑grid cabins and remote telecom sites.

ü Recreational vehicles, camper vans, and caravans.

ü Marine deep‑cycle house banks for sailboats and powerboats.

ü Electric bicycles, scooters, and mobility devices.

ü Portable power stations and backup battery packs.

ü Small‑to‑mid‑size EVs and material‑handling equipment (forklifts, golf carts).

ü Grid‑tied battery storage for peak shaving and load shifting.

ü Lightweight robotics and UAV/industrial drones.

ü Emergency lighting and traffic signaling equipment.

Lead‑Acid (Flooded, AGM, Gel)

ü Automotive starter (SLI) batteries for cars, trucks, and motorcycles.

ü Uninterruptible power supplies for data centers and telecom hubs.

ü Backup power for security systems and emergency lighting.

ü Large‑scale grid energy storage in stationary battery banks.

ü Forklifts, floor scrubbers, and other industrial motive‑power applications.

ü Marine starting and deep‑cycle batteries for boats and yachts.

ü Renewable‑energy storage in off‑grid solar and wind installations.

ü Railway signaling and substation power support.

ü Golf carts and neighborhood electric vehicles.

ü Portable jump‑starter packs and battery boosters.

Supply Chain of Global LFP Battery and Lead Acid Battery

LFP battery supply chains depend on China's integrated control over phosphate mining, lithium refining, and cathode manufacturing. Chinese battery manufacturers oversee raw materials and cell assembly. Due to the high technical threshold, only a few of the leading companies can master the key technology of high-pressure dense lithium iron phosphate. Small and medium-sized enterprises still face many challenges in overcoming technical barriers. [3]

Lead-acid battery supply chains are globally distributed. They use primary lead from mining and secondary lead from recycling. A mature closed-loop system recycles over 95% of batteries in North America and Europe.

While LFP production is exposed to geopolitical and raw material bottlenecks, lead-acid systems benefit from a stable, circular economy model. So, in LiFePO4 vs. lead acid, the former offers higher energy density but faces supply chain fragility. The latter provides stoutness through established recycling infrastructures.

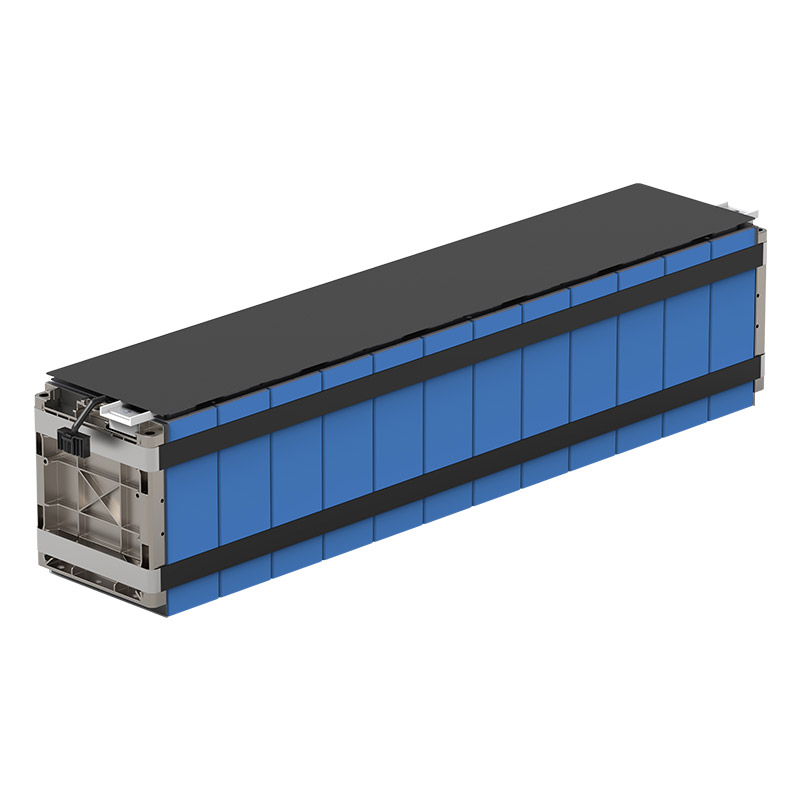

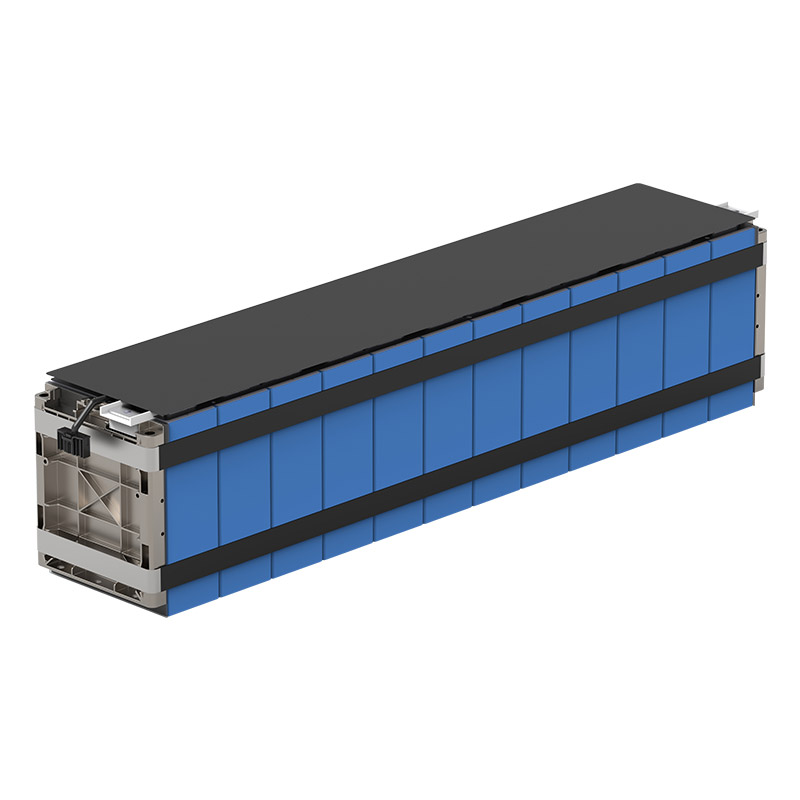

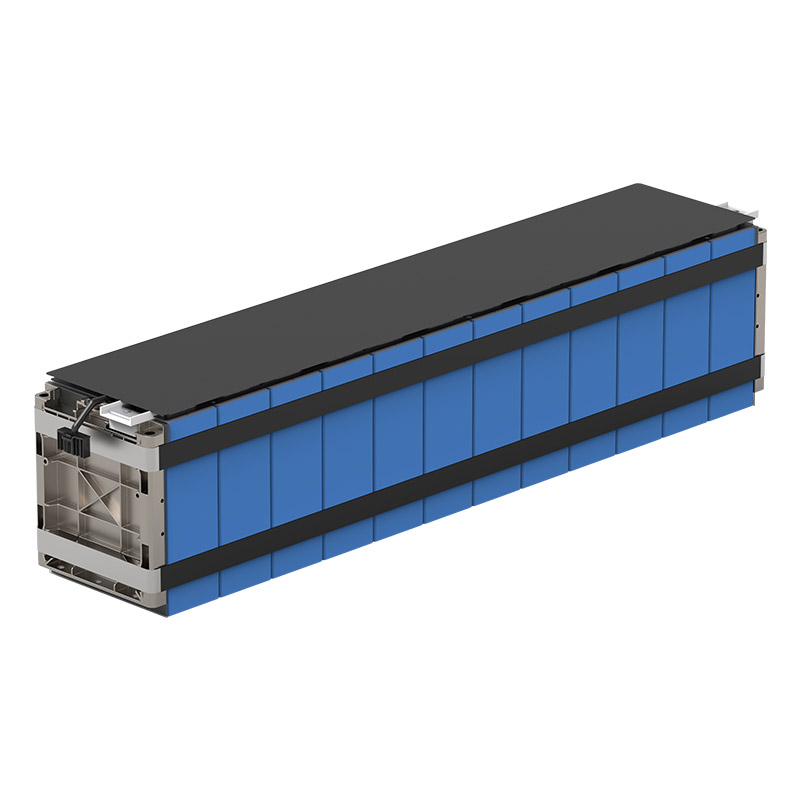

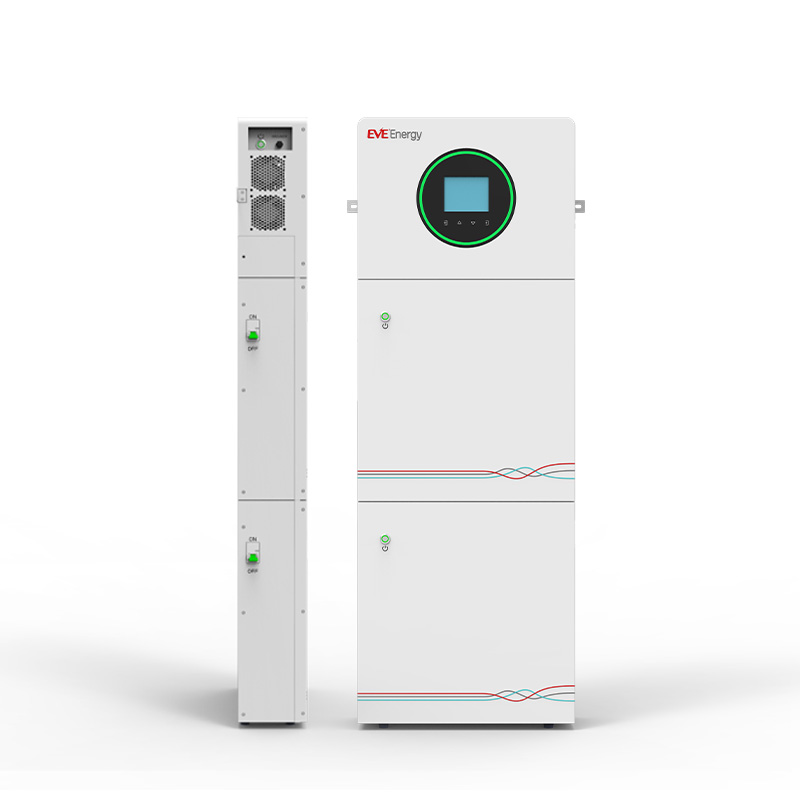

EVE: A Trusted LFP Battery Manufacturer and Supplier

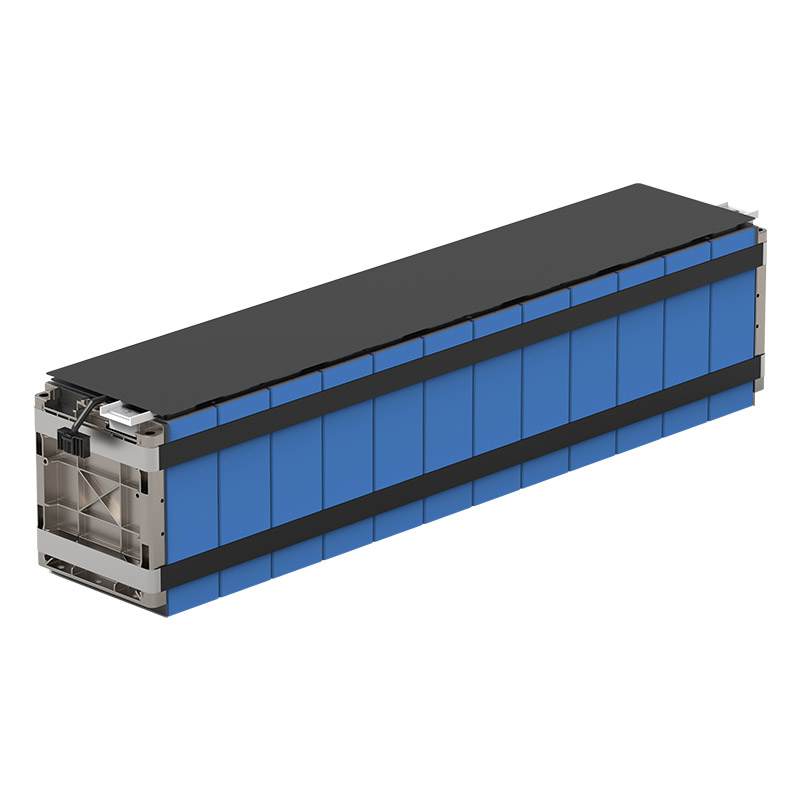

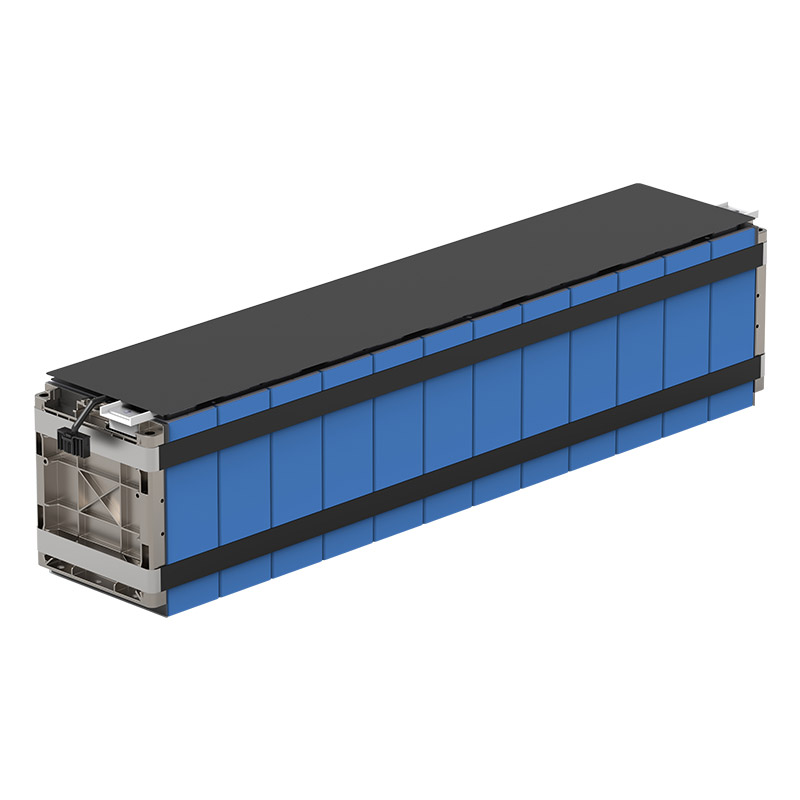

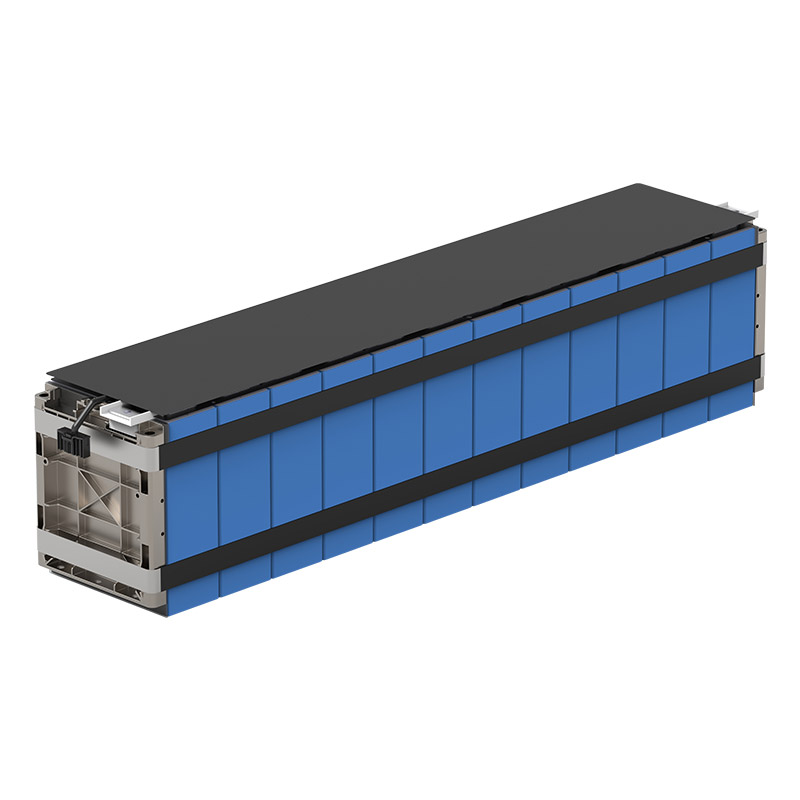

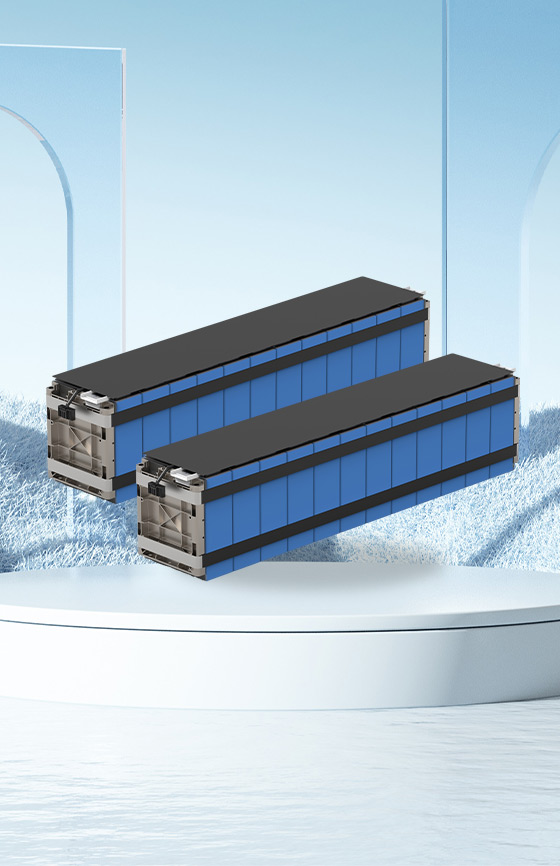

At EVE, we are among the top-notch LFP battery manufacturers and LFP battery suppliers and offer cylindrical and prismatic cell formats for high-demand uses. Our LF304 prismatic cell offers 3.2v at 304Ah and supports 4000 cycles for forklifts and trucks. Energy density, life, and safety are advantages of LiFePO4 over lead-acid batteries. This cell combines robust cycle life and thermal resilience to ensure reliable performance in demanding environments.

Wrapping Up

In summary, LiFePO4 batteries outperform traditional lead-acid batteries in almost every key metric. It offers higher usable energy density, deeper discharge tolerance, far longer cycle life, and significantly safer thermal stability, while lead-acid remains limited by lower efficiency, shorter service life, and bulkier size.

These strengths make LiFePO4 the clear choice for demanding applications from commercial vehicles to renewable energy storage, and its increasingly mature, vertically integrated supply chain now supports scalable production at competitive cost.

EVE has leveraged this trend to become one of the Top 2 suppliers in China’s commercial-vehicle battery market in 2024—offering a full spectrum of cell formats (pouch, large cylindrical, prismatic LFP and NCM) including flagship prismatic LFP cells LF125, LF150 and LF304—ensuring reliable delivery, consistent quality, and the optimized performance your projects demand.

Reference:

[1]https://www.researchnester.com/reports/lithium-iron-phosphate-lifepo4-battery-market/3676

[2]https://www.fortunebusinessinsights.com/industry-reports/lead-acid-battery-market-100237

[3]http://epaper.zqrb.cn/html/2025-04/08/content_1133807.htm?div=0